Hong Kong life premiums projects steady growth to $96.5bn by 2026

The easing of restrictions is bringing back demand from Chinese mainlanders.

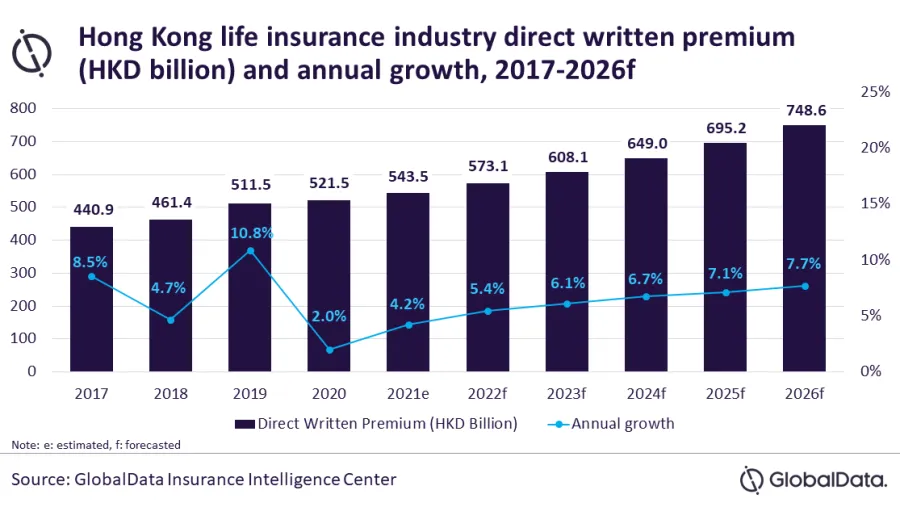

Hong Kong’s life insurance industry is projected to grow at a compound annual growth rate (CAGR) of 6.6% from $70.0bn in 2021 to $96.5bn in 2026, in terms of direct written premiums (DWP), according to data and analytics firm GlobalData.

GlobalData insurance analyst Anjuli Srivastava said that the life insurance segment in Hong Kong will grow 5.4% in 2022, supported by the growing demand for protection-linked plans, new product developments, and the resumption in the sale of life insurance policies to mainland Chinese visitors due to easing travel restrictions.

Demand from Chinese mainland visitors is the largest contributor in the whole life segment which is also the largest segment with a DWP share of 64.8% in 2020. It declined by 1.1% that same year due to pandemic-led travel restrictions but prior to that, a large proportion of whole life insurance premiums were attributed to Chinese visitors who purchased their policies from Hong Kong due to favorable terms and greater flexibility offered to them as compared to policies sold in China.

Endowment insurance was the second-largest line with a 13.4% share in 2020. It grew by 17.5% in 2020, driven by strong demand for high return insurance policies. The introduction of investment-linked insurance with high mortality coverage is expected to support the demand for endowment products. Endowment insurance is expected to grow at a CAGR of 9.9% during 2021-2026.

Meanwhile, general annuity, which is the third-largest line with a DWP share of 9.3%, was declined by 16.2% in 2020. It is expected to grow at a CAGR of 6.3% during 2021-2026, driven by demographic factors such as higher life expectancy. In addition, the introduction of tax benefits on Qualified Deferred Annuity Policies in September 2021 will further support the demand for annuity products. Term life, pension, and other life insurance lines accounted for the remaining 12.5% share.

“Hong Kong’s life insurance market is expected to be the third-highest in the Asia-Pacific region, after India and China, with a projected CAGR of 6.6% during 2021-2026. Gradual resumption in economic activities and increase in the sale of life insurance policies to mainland Chinese visitors are expected to support the growth of Hong Kong life insurance market over the next five years,” Srivastava said.

You may also like:

Vietnam general insurance industry to reach $3.5b in 2026

Hong Kong premiums dips by almost 1% to $76.98 in 2021

AIA's smart calculator helps Singaporeans' figure out their financial weaknesses

Advertise

Advertise